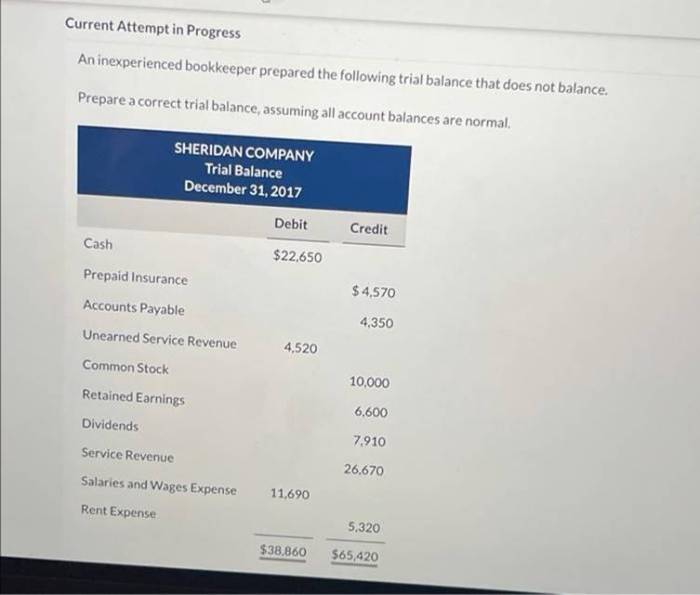

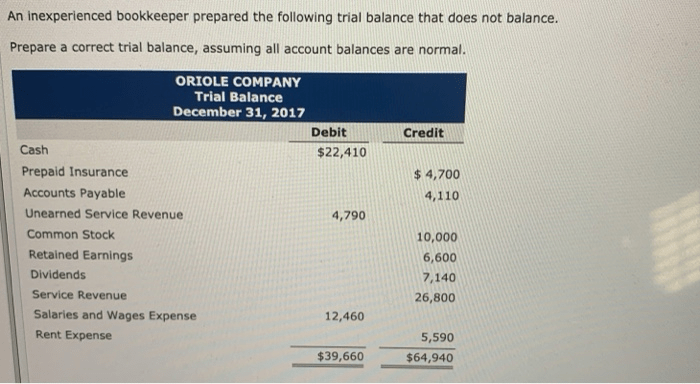

An inexperienced bookkeeper prepared the following trial balance, setting the stage for a tale of accounting mishaps and their far-reaching consequences. As we delve into the intricacies of trial balance preparation, we will uncover the common pitfalls that can ensnare novice bookkeepers, jeopardizing the accuracy of financial reporting.

Errors in trial balances, like rogue puzzle pieces, disrupt the delicate balance of financial statements, distorting performance metrics and obscuring the true financial position of an organization. Join us on this journey of discovery as we explore the methods for identifying and rectifying these errors, ensuring the integrity of financial reporting and safeguarding the reliability of business decision-making.

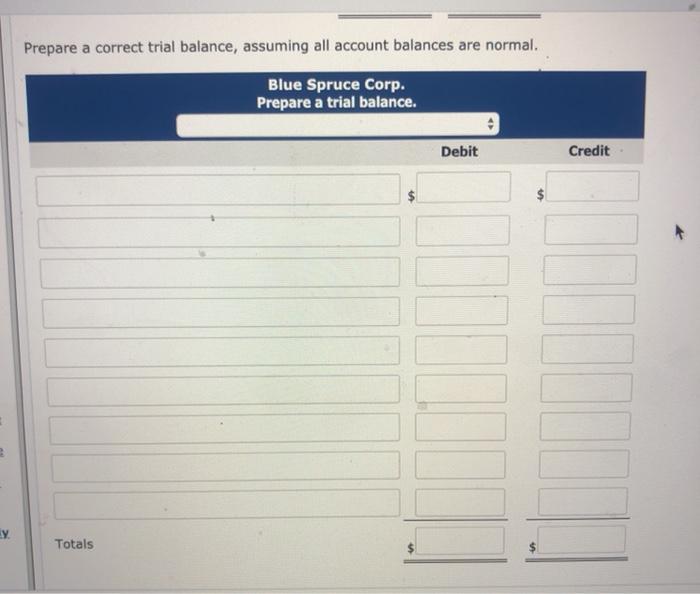

Trial Balance Discrepancies: An Inexperienced Bookkeeper Prepared The Following Trial Balance

Inexperienced bookkeepers may encounter several common errors when preparing a trial balance. These errors can significantly impact the accuracy of the trial balance, leading to incorrect financial reporting.

Some common errors include:

- Transposition errors: Incorrectly reversing the digits in a number, e.g., 123 as 321.

- Omission errors: Failing to include an account or transaction in the trial balance.

- Duplication errors: Including the same account or transaction twice in the trial balance.

- Sign errors: Entering an amount with an incorrect sign (positive or negative).

- Calculation errors: Miscalculating the balance of an account.

Identifying and Correcting Errors

To identify errors in a trial balance, bookkeepers can use the following methods:

- Crossfooting: Adding up the debit and credit columns of the trial balance to ensure they are equal.

- T-account analysis: Reconciling the balance of individual accounts in the trial balance to their respective T-accounts.

- Scanning for unusual items: Reviewing the trial balance for any transactions or balances that appear unusual or inconsistent.

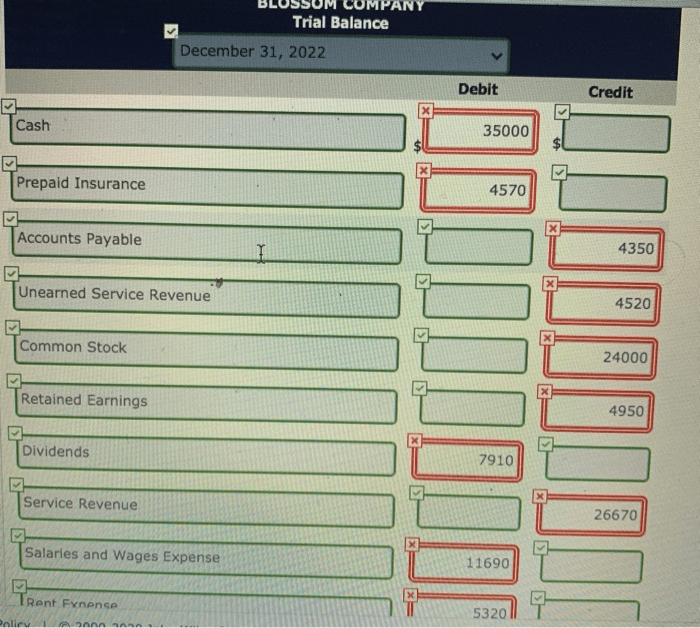

Once errors are identified, bookkeepers should follow these procedures to correct them:

- Identify the source of the error.

- Make the necessary adjustments to the trial balance.

- Re-crossfoot the trial balance to ensure it is now balanced.

Impact on Financial Statements

Errors in the trial balance can have significant consequences for the accuracy of financial statements. Incorrect trial balances can lead to:

- Misstated net income or loss.

- Overstated or understated assets, liabilities, or equity.

- Distorted financial ratios and other financial performance metrics.

These errors can mislead users of financial statements, such as investors, creditors, and management, about the true financial health and performance of a company.

Best Practices for Bookkeeping, An inexperienced bookkeeper prepared the following trial balance

To avoid errors in the trial balance, inexperienced bookkeepers should follow these best practices:

- Maintain accurate and complete accounting records.

- Regularly reconcile accounts to supporting documentation.

- Use a trial balance worksheet to assist in the preparation of the trial balance.

- Review the trial balance carefully before finalizing it.

- Seek guidance from experienced bookkeepers or accountants if needed.

User Queries

What are the most common errors made by inexperienced bookkeepers in preparing trial balances?

Inexperienced bookkeepers may make errors such as transposing numbers, omitting transactions, posting to incorrect accounts, and failing to consider adjusting entries.

How can errors in trial balances impact financial statements?

Errors in trial balances can lead to inaccurate financial statements, which can misrepresent a company’s financial performance and position, potentially misleading stakeholders.

What are the best practices for inexperienced bookkeepers to avoid errors in trial balances?

Best practices include maintaining accurate records, reconciling accounts regularly, and adhering to established accounting principles.