Survey of accounting 8th edition – Welcome to the realm of accounting, where Survey of Accounting, 8th Edition, stands as an indispensable guide. This comprehensive textbook delves into the intricacies of financial reporting, empowering you with the knowledge and skills to navigate the complex world of business and finance.

Through its meticulously crafted content and engaging explanations, Survey of Accounting, 8th Edition, unveils the significance of accounting standards, the principles of financial reporting, and the art of transaction analysis. With each chapter, you’ll gain a deeper understanding of the accounting equation, adjusting entries, and the crucial role of internal control in ensuring the integrity of financial information.

Introduction

The eighth edition of the Survey of Accounting textbook provides a comprehensive overview of the fundamental concepts and principles of accounting. It is designed to introduce students to the basics of accounting and prepare them for further study in the field.

This edition has been updated to reflect the latest changes in accounting standards and practices. It also includes new content on emerging topics, such as data analytics and sustainability reporting.

Conceptual Framework and Accounting Standards

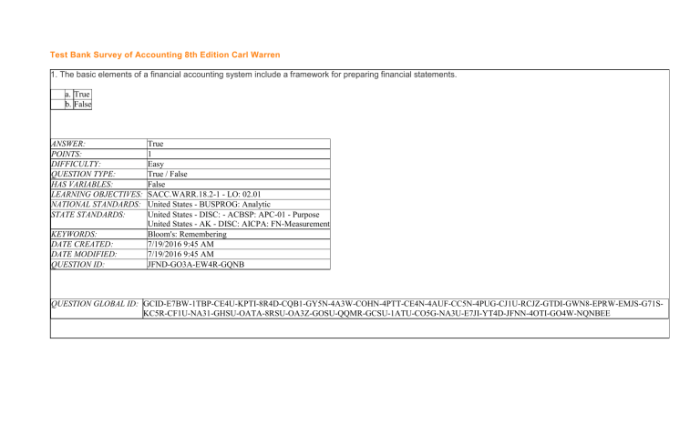

The conceptual framework is a set of concepts and principles that guide the development of accounting standards. It provides a foundation for consistent and reliable financial reporting.

Accounting standards are rules and regulations that govern the preparation of financial statements. They are developed by accounting standard-setting bodies, such as the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

Key Accounting Standards

- Statement of Financial Accounting Standards (SFAS) No. 157, Fair Value Measurements

- International Financial Reporting Standard (IFRS) No. 16, Leases

- Statement of Financial Accounting Concepts (SFAC) No. 8, Conceptual Framework for Financial Reporting

Financial Reporting

Financial statements are used to communicate financial information to users, such as investors, creditors, and management. They include the balance sheet, income statement, statement of cash flows, and statement of changes in equity.

The principles of accrual accounting require that transactions be recorded in the periods in which they occur, regardless of when cash is received or paid.

Common Financial Statement Items

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

Transaction Analysis

The accounting equation is a fundamental equation that is used to record transactions. It states that assets = liabilities + equity.

Transactions are events that affect the accounting equation. They can be classified as either debits or credits.

Types of Transactions

- Asset acquisitions

- Liability incurrences

- Equity investments

- Revenue recognition

- Expense recognition

Adjusting Entries

Adjusting entries are made at the end of an accounting period to update the accounts and ensure that the financial statements are accurate.

There are four types of adjusting entries: accruals, deferrals, depreciation, and amortization.

Common Adjusting Entries

- Accrued expenses

- Deferred revenues

- Depreciation of fixed assets

- Amortization of intangible assets

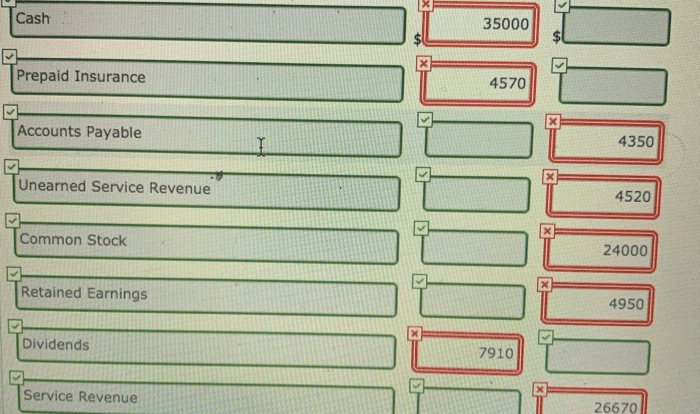

Closing Entries and Financial Statement Preparation: Survey Of Accounting 8th Edition

Closing entries are made at the end of an accounting period to close the temporary accounts and transfer their balances to the permanent accounts.

The steps involved in preparing financial statements from trial balances are:

- Prepare an adjusted trial balance.

- Prepare a closing entry for each temporary account.

- Post the closing entries to the ledger.

- Prepare a post-closing trial balance.

- Prepare the financial statements.

Internal Control

Internal control is a system of policies and procedures that are designed to protect an organization’s assets and ensure the accuracy of its financial records.

The components of an effective internal control system include:

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

Financial Analysis

Financial analysis is the process of using financial information to evaluate a company’s financial performance and position.

Financial ratios are used to compare a company’s financial performance to that of other companies or to its own past performance.

Common Financial Ratios, Survey of accounting 8th edition

- Current ratio

- Debt-to-equity ratio

- Gross profit margin

- Net profit margin

- Return on assets

Frequently Asked Questions

What are the key changes in the 8th edition of Survey of Accounting?

The 8th edition of Survey of Accounting features updated content to reflect the latest accounting standards, enhanced examples and illustrations for improved clarity, and a focus on real-world applications to bridge the gap between theory and practice.

How does Survey of Accounting, 8th Edition, approach financial reporting?

Survey of Accounting, 8th Edition, emphasizes the importance of financial reporting in providing transparent and reliable information to stakeholders. It explores the principles of accrual accounting, the different types of financial statements, and the impact of accounting standards on financial reporting practices.

What is the significance of transaction analysis in accounting?

Transaction analysis is the foundation of accounting, as it involves recording and classifying business transactions to create a clear and accurate picture of a company’s financial activities. Survey of Accounting, 8th Edition, provides a step-by-step guide to transaction analysis, using the accounting equation to demonstrate the impact of each transaction on the financial statements.