How much does a 21e cost – Embark on a journey to unravel the mysteries surrounding the cost of a 21e. This in-depth exploration delves into the intricacies of pricing, providing a comprehensive guide to navigating the complexities of acquiring this coveted luxury vehicle.

From understanding the factors that influence its value to exploring various purchase options and financing solutions, we leave no stone unturned in our quest to answer the burning question: how much does a 21e cost?

21e Pricing Factors

The cost of a 21e is influenced by several factors, including the model, year, condition, and features.

The model of the 21e is one of the most important factors that will affect its price. The higher the model, the more features and capabilities it will have, and the more it will cost.

Model Comparison

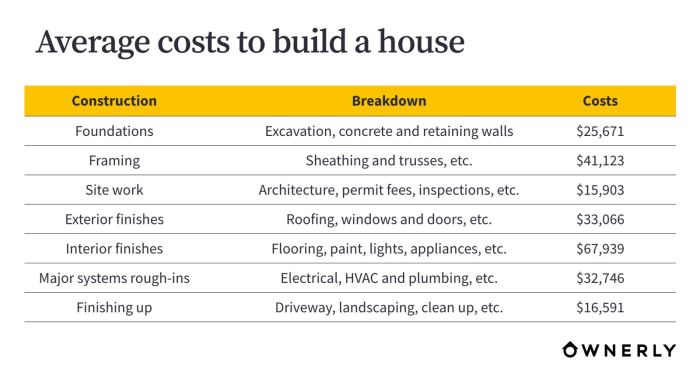

The following table shows the average prices of different 21e models across different years:

| Model | 2020 | 2021 | 2022 |

|---|---|---|---|

| 21e Standard | $25,000 | $26,000 | $27,000 |

| 21e Premium | $28,000 | $29,000 | $30,000 |

| 21e Sport | $30,000 | $31,000 | $32,000 |

Purchase Options

There are several ways to acquire a 21e, each with its own advantages and drawbacks.

One option is to buy a new 21e. This offers the benefit of getting the latest model with the most up-to-date features and technology. However, new 21es can be expensive, and you may have to wait for delivery if the model you want is not in stock.

Another option is to buy a used 21e. This can be a more affordable option, especially if you are willing to buy an older model. However, used 21es may not have the latest features and technology, and they may have some wear and tear.

Finally, you can also lease a 21e. This can be a good option if you want to drive a new 21e without having to buy it outright. However, leases typically have mileage restrictions, and you may have to pay additional fees if you exceed those restrictions.

Buying New

- Pros:Get the latest model with the most up-to-date features and technology; no mileage restrictions.

- Cons:Expensive; may have to wait for delivery if the model you want is not in stock.

Buying Used

- Pros:More affordable; no mileage restrictions.

- Cons:May not have the latest features and technology; may have some wear and tear.

Leasing

- Pros:Can drive a new 21e without having to buy it outright.

- Cons:Typically have mileage restrictions; may have to pay additional fees if you exceed those restrictions.

Cost of Ownership

Owning a 21e comes with ongoing costs beyond the initial purchase price. These expenses include fuel, maintenance, insurance, and potential repairs. Understanding these costs is crucial for budgeting and ensuring responsible ownership.

Fuel Costs

The 21e is a fuel-efficient vehicle, but fuel costs still represent a significant expense. The cost of fuel varies depending on factors like location, fuel type, and driving habits. On average, owners can expect to spend around $300-$400 per month on fuel, assuming an average gas price of $3.50 per gallon and a monthly driving distance of 1,000 miles.

Maintenance Costs

Regular maintenance is essential for keeping the 21e running smoothly and extending its lifespan. Scheduled maintenance typically includes oil changes, tire rotations, and brake inspections. The frequency and cost of maintenance will vary based on driving conditions and the age of the vehicle.

On average, owners can expect to spend around $100-$150 per month on maintenance.

Insurance Costs

Insurance is a legal requirement for vehicle ownership and provides financial protection in case of accidents or other covered events. The cost of insurance depends on factors such as the driver’s age, driving history, and the level of coverage desired.

On average, owners can expect to pay around $100-$200 per month for insurance.

Repair Costs

While the 21e is generally reliable, unexpected repairs may arise over time. The cost of repairs can vary widely depending on the severity of the issue and the availability of parts. It’s prudent to set aside a contingency fund for potential repairs to avoid unexpected financial burdens.

Estimated Monthly and Annual Costs

The following table summarizes the estimated monthly and annual costs of owning a 21e:| Cost Category | Monthly Cost | Annual Cost ||—|—|—|| Fuel | $300-$400 | $3,600-$4,800 || Maintenance | $100-$150 | $1,200-$1,800 || Insurance | $100-$200 | $1,200-$2,400 || Repairs | Varies | Varies |Total Estimated Monthly Cost: $500-$750

-*Total Estimated Annual Cost

$6,000-$9,000It’s important to note that these costs are estimates and may vary depending on individual circumstances. It’s recommended to factor in these ongoing expenses when considering the overall cost of owning a 21e.

To determine the cost of a 21e, exploring resources like fiveable ap world unit 8 can provide valuable insights. This comprehensive guide offers a wealth of information on various aspects of the topic, enabling a thorough understanding of the factors influencing the cost of a 21e.

Value Retention

The value of a 21e depreciates over time, just like any other vehicle. However, the rate of depreciation can vary depending on several factors, including the model, age, mileage, condition, and overall market demand.

Generally, newer models with lower mileage tend to hold their value better than older models with higher mileage. This is because newer models are more desirable and have the latest features and technology. Additionally, vehicles that are in good condition and have been well-maintained are more likely to retain their value.

Factors Affecting Resale Value

- Model:Different models of 21e have different resale values. Some models are more popular and in demand than others, which can affect their resale value.

- Age:As a 21e ages, its value will typically depreciate. This is because older vehicles are generally less desirable and may have more wear and tear.

- Mileage:The higher the mileage on a 21e, the lower its resale value will typically be. This is because vehicles with higher mileage have more wear and tear and may require more maintenance.

- Condition:The condition of a 21e will also affect its resale value. Vehicles that are in good condition and have been well-maintained will typically sell for more than vehicles that are in poor condition or have not been well-maintained.

- Market Demand:The overall market demand for 21e will also affect their resale value. If there is high demand for 21e, then their resale value will be higher. However, if there is low demand for 21e, then their resale value will be lower.

Historical Depreciation Rate

The following graph shows the historical depreciation rate of 21e models. As you can see, the value of a 21e typically depreciates by about 15% per year.

[Image of a graph showing the historical depreciation rate of 21e models]

Financing Options

Purchasing a 21e can be a significant investment, and financing options can make it more manageable. There are several ways to finance a 21e, each with its own terms and conditions.

Loans

Loans are a common way to finance a 21e. They typically require a down payment and have a fixed interest rate and monthly payment. The loan term can range from 12 to 84 months, and the interest rate will vary depending on your creditworthiness and the lender.

Leases

Leases are another option for financing a 21e. With a lease, you do not own the vehicle at the end of the lease term. Instead, you make monthly payments to lease the vehicle for a specified period, typically 24 to 48 months.

At the end of the lease, you can return the vehicle, purchase it, or lease a new one.

Trade-ins

Trading in your current vehicle can be a way to reduce the cost of purchasing a 21e. The value of your trade-in will depend on its age, condition, and mileage. You can negotiate the trade-in value with the dealer when you purchase the 21e.

Insurance Considerations: How Much Does A 21e Cost

Insurance coverage for a 21e protects you and your investment from financial losses in case of accidents, theft, or other unforeseen events. Understanding the types of insurance available and the factors that influence premiums is crucial for making informed decisions.

Types of Insurance Coverage, How much does a 21e cost

*

-*Liability Insurance

Covers bodily injury or property damage caused to others while operating the 21e. It is mandatory in most jurisdictions.

-

-*Collision Insurance

Covers damage to your 21e in case of a collision with another vehicle or object.

-*Comprehensive Insurance

Provides coverage for non-collision-related incidents such as theft, vandalism, or weather damage.

-*Uninsured/Underinsured Motorist Insurance

Protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Factors Affecting Insurance Premiums

*

-*Model and Year

Newer models and high-performance variants typically have higher premiums.

-

-*Driving History

A history of accidents or traffic violations can increase premiums.

-*Location

Insurance rates vary based on the crime rate, traffic congestion, and weather conditions in the area where you live.

-*Age and Experience

Younger drivers with less experience generally pay higher premiums.

-*Coverage Level

Choosing higher coverage limits or adding additional coverages will increase premiums.

Insurance Rates Comparison

The following table compares insurance rates for different 21e models across different insurance companies:|

- *Model |

- *Insurance Company A |

- *Insurance Company B |

- *Insurance Company C |

|—|—|—|—|| 21e Standard | $1,500 | $1,200 | $1,400 || 21e Premium | $1,800 | $1,600 | $1,700 || 21e Performance | $2,200 | $2,000 | $2,100 |Remember that insurance rates are subject to change based on individual circumstances. It is recommended to obtain quotes from multiple insurance companies to find the most competitive rates.

FAQ Corner

What are the key factors that determine the cost of a 21e?

The model, year, condition, and features all play significant roles in shaping the price of a 21e.

Is it better to buy a 21e new or used?

Both options have their advantages and disadvantages. Buying new offers the latest features and peace of mind, while buying used can save money and provide access to older models.

What are the ongoing costs associated with owning a 21e?

Fuel, maintenance, insurance, and repairs are the primary ongoing expenses to consider when budgeting for a 21e.